While finding deals and helping you save money is a lot of fun, however, for this post, I'm taking a break from the deals to post about something that is much more important, saving for your future. Whether you are single, starting a family or nearing retirement, the importance of saving for your future can NOT be ignored. In these unstable times it is a MUST.

Consider this…

If your child is 6 years old, they are 1/3rd of the way towards collage. If they are 12, you only have 6 short years to go. Think back on how fast those first 6 years have gone and you will realize how imperative it is that you do something now. Time flies when you put it in that perspective. If you are putting off saving for your future, before you know it, your future will be your past. Don't wait.

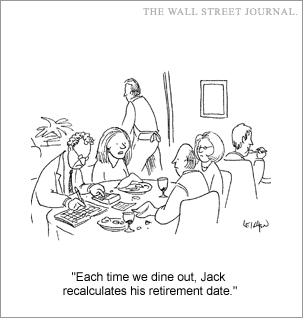

(source: The Wallstreet Jorunal)

My own hubs is just 6 years from taking this next step in our life and even with careful planning, the unstable market along with inflation and life's little and big surprises, we have seen some major setbacks. We are constantly having to re-evaluate and are glad to have someone we can count on to help us through the bumpy roads.

I asked a dear friend of mine, who I consider an expert in financial planning, Michael Maddocks, to give us all some tips. Mike has over 10 years of experience with Ameriprise helping people plan for their future. He works with everyday people, at all income levels, in a non-threatening and dignified way. Whether you are young and just getting started, planning for a child's college or like us nearing retirement, it's ALWAYS a good idea to sit down and get a professionals outside perspective.

With that in mind, here are the top 5 tips Michael has to offer. I would urge you to consult with someone for your individual needs.

Build up an emergency fund and refill it if used:

You need to be building up an emergency fund, even if you are trying to pay off debt. It's important to pay yourself first. Use automatic savings plans so you never see the money. If an emergency does arrive, having an emergency fund will prevent you from having to break out a credit card or take out a loan that would otherwise create the endless cycle of more debt. A healthy short term emergency fund should have 3 to 6 months of your family's income.

Pay it off:

Do everything in your power to pay off all unsecured debt. Cancel your cable bill and delete all other unnecessary expenses until this is accomplished. Make a list of each of your expenses and determine if they are actually necessary for survival. You'll be surprised at how much you can live without and how much those little necessities cost you.

Apply for the appropriate amount of life insurance:

Having the appropriate amount of life insurance is more important than being on track for retirement – or any other financial goal. If you save $1,000 in a retirement fund and you die, your beneficiaries get $1,000. If you have directed some of that $1,000 towards life insurance, your beneficiaries will receive a lot more than $1,000. Having insurance through your employer is not enough. You may lose this insurance with job changes, so make sure you are also covered elsewhere.

Ignore the Myths:

Myth #1: It’s too early to think about investing. It’s never too early to think about investing. If you have 25-30 years before you retire, time is on your side. Here’s an example: If you plan to retire in 30 years and you save $100 per month at a modest rate of 6%, you will have $100,451.50 saved up. If you delay saving for 5 years, you will have $69,299.40 saved up. That’s a difference of over $31,000. So you’re out about 30% of what you could have saved because you waited.

Myth #2: It’s too late to start. I hope you don’t think you’re in this camp. Even if you’re approaching retirement, it’s never too late to evaluate and improve your financial situation.

DO SOMETHING NOW! ANYTHING!

Even if the changes you make right now seem insignificant, little changes can lead to big rewards. Start today to improve your financial future. Review all of these tips again and ask yourself if you are 100% on track. Consider consulting with a financial advisor to help you meet your goals – most provide a free initial consultation. If you find you're ready for the next steps, they can help you determine the appropriate amount of life insurance and get you started on your monthly investment plan. The process is painless. SO GET STARTED!

This post was not paid for or sponsored by Ameriprise. We just think saving money is a pretty darned important and hope it inspires some of you to start making those important changes to your lifestyle. Contact info Michael Maddocks.

Leave a Reply